Sticker Shock– Missoula Property Tax Statements are in the Mail

We’ve all been warned for the last year or so that property taxes will be higher, much higher due to the massive increase in overall property values over the past 18 months.

Missoula County Clerk and Treasurer Tyler Gernant spoke to KGVO News bright and early on Monday morning with the news.

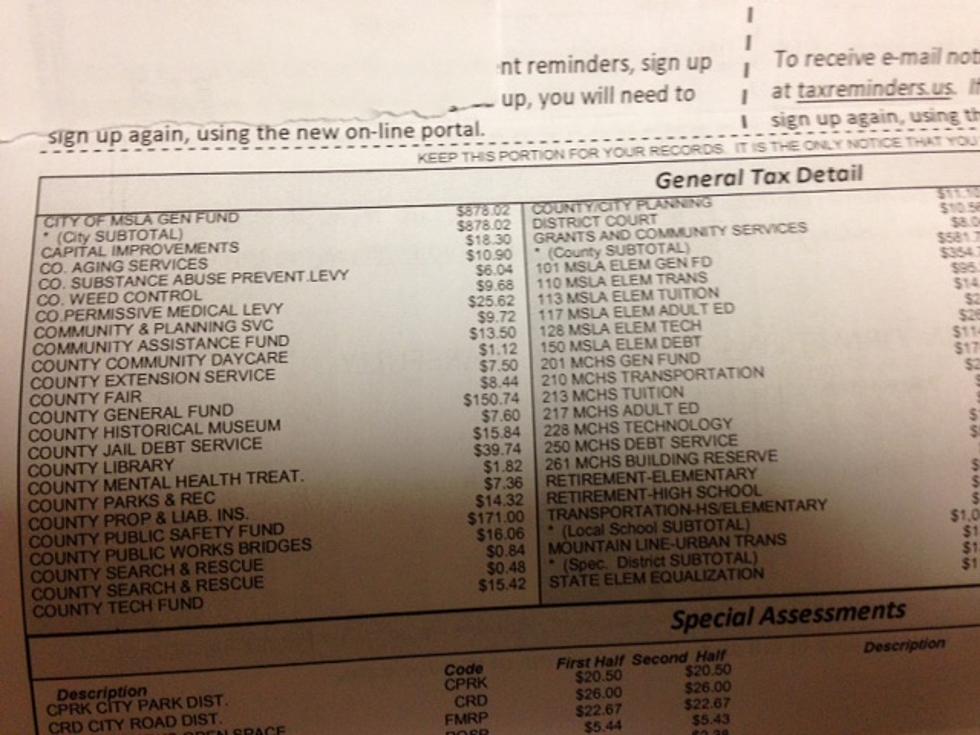

“You'll be getting the same style property tax bill that you've been getting for the last few years,” said Gernant. “All of those will get mailed at the latest on October 28th, so you should have them in your mailboxes either later this week or first thing next week. They're also all available online, and they have been for about a week now. So if you go to Missoula taxes.us, you can look up your tax bill by either your personal number or by your name.”

The last time KGVO spoke to Gernant, he said the worst of the property tax increases would be coming this year, and he was right.

“I hate to say I told you so, but those changes did come to fruition. For probably the vast majority of people, your taxes went up,” he said. “For a lot of folks, they went up by quite a bit. There are, and I say this every year, there are some sort of magical unicorns whose taxes did go down, and their appraised value went down. Those are few and far between but they do exist. For most folks, your taxes went up and for a lot of folks they went up a lot.”

The last time KGVO spoke to Gernant, he said the worst of the property tax increases would be coming this year, and he was right.

Gernant had advice on where to apply for relief for those who have a complaint about their property taxes.

“The first thing I do is encourage you to go online,” he said. “The Department of Revenue has a property record card, and if you go to the Montana Department of Revenue's site and make sure that everything that's on your property record card is accurate, because that tends to be the biggest reason for mistakes and higher taxes. It may be that there's a basement that doesn't exist or maybe you're getting taxed for a shed that you don't have anymore, and so making sure that that's accurate is going to be the first step for you.”

One very important point that Gernant wanted to make was that your property taxes must be paid on time, or there are substantial penalties.

“There's a pretty stiff penalty if you pay even just a minute late,” he said. “So we really recommend that you pay on time. It’s two percent of whatever the tax payment was. So if you owed $100, then you would have a two percent or two dollar penalty immediately when you pay it late. In addition to that, there's an interest component that charges 10 percent per year, that's going to be on that delinquent payment, so it does get pretty stiff. The somewhat good news is, is if you're mailing in your tax payment, then the postmark date is what we use. So you can mail it at any point up to the due dates and we still counted as timely payment.”

Tax payments for the first half of the year are due by November 30, 2021. Use the pre-printed coupon you receive in the mail, or you can pay online.

LOOK: 50 famous memes and what they mean

More From Montana Talks